- The 2021 budget submission represents an inflection point for missile defense programs, the relationship between active defenses and other forms of missile defeat, and the institutional makeup of the missile defense enterprise.

- This is the first Trump administration budget submission to make major programmatic changes to missile defense, but these changes carry uncertainty about the future.

- Despite congressional opposition, the administration’s budget again tries to transfer space sensor development from the Missile Defense Agency to the Space Development Agency.

- Army and Navy investments in air and missile defenses are beginning to transition from research and development to procurement.

- Despite one program cancellation, hypersonic strike development efforts continue to advance.

Introduction

The Trump administration released its 2021 budget request on February 10, 2020. With respect to missile defense and related programs, it makes the kind of significant programmatic changes one might expect in an administration’s first or second year, rather than its fourth. Whereas neither the 2019 Missile Defense Review (MDR) nor the 2020 budget submission substantially changed the previous program of record, the 2021 budget begins to break some programmatic china.1 It remains to be seen whether these changes represent a coherent and sustainable path and if they will support better realignment of missile defense efforts to the National Defense Strategy’s focus on major powers.2

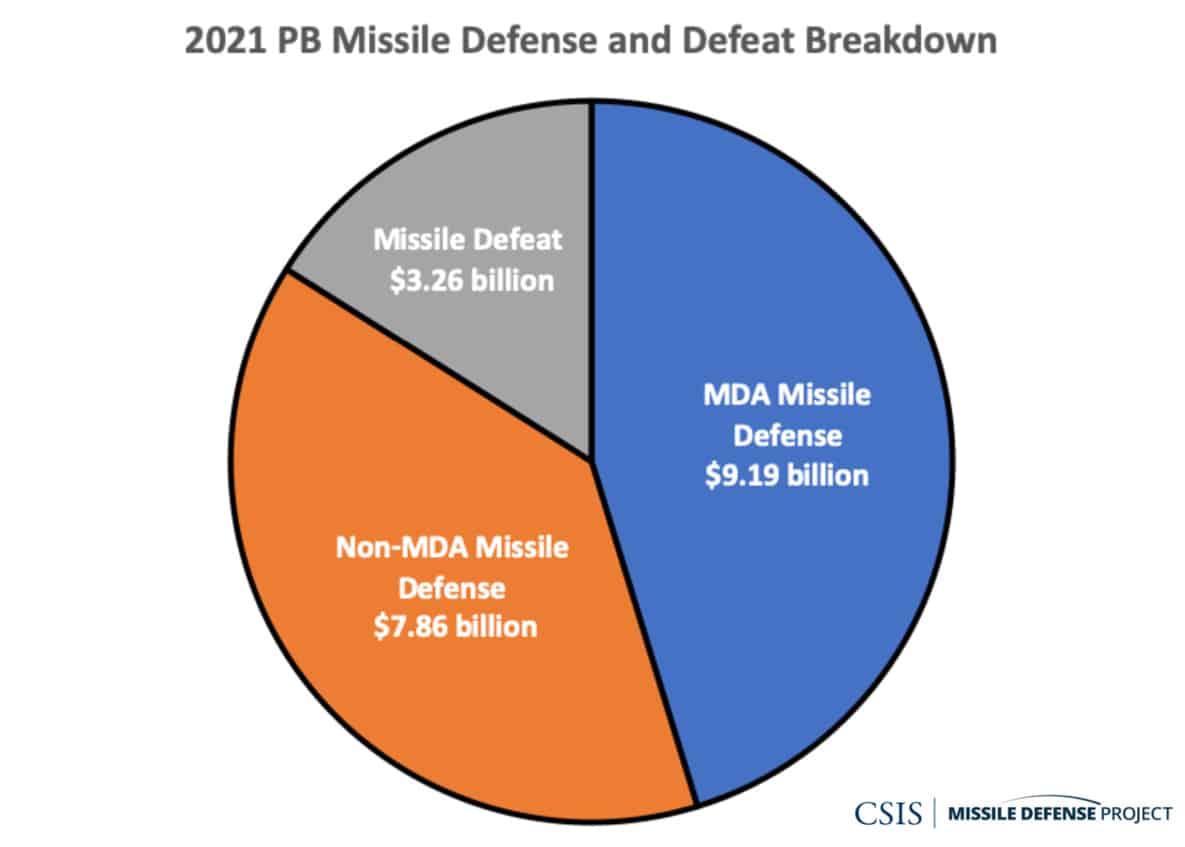

One feature of the 2021 defense budget request is its highlight of $20.3 billion allocated to “missile defense and defeat” programs. This category includes traditional missile defense efforts in the Missile Defense Agency (MDA) and also those in the Space Development Agency (SDA), the Defense Advanced Research Projects Agency (DARPA), and several military services. It also includes activities historically associated with strategic warning and programs to defeat missiles before their launch, especially by means of hypersonic strike. Although far from being realized, this reporting method reflects a desire for a more comprehensive and integrated approach to countering various missile threats.3

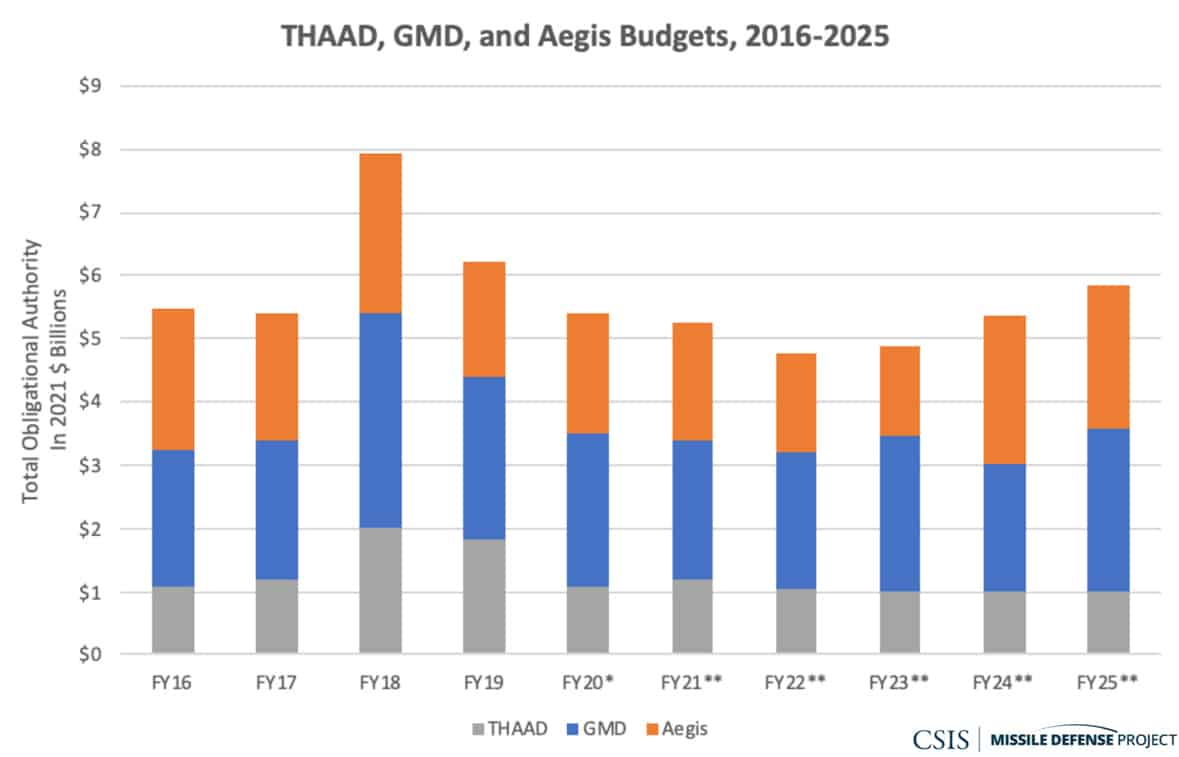

The most substantial changes to the program of record involve the reorientation of Ground-based Midcourse Defense (GMD). These include the cancellation of the Redesigned Kill Vehicle (RKV), beginning work on a Next Generation Interceptor (NGI), and the indefinite postponement of two homeland defense radars. NGI represents an attempt to develop a much more robust capability for homeland ballistic missile defense. Both Congress and other parts of the executive branch have expressed skepticism about initial NGI plans, especially with its originally planned 2030 delivery date. Congress has pushed for alternative interim solutions, including upgrades to the currently deployed kill vehicles. The MDA budget proposes to evolve Aegis and Terminal High Altitude Area Defense (THAAD) systems to support layered homeland defense, a blurring that echoes the MDR’s formulation about “transregional” missile defense (Figure 1).

Figure 1: THAAD, GMD, and Aegis Budgets, 2016-2025

Massive resource shifts accompany NGI’s debut. Despite past calls by Under Secretary of Defense for Research and Engineering Dr. Michael Griffin and others for MDA to bolster its advanced technology efforts, the 2021 budget seems to push MDA in the opposite direction. The budget reduces hypersonic defense efforts and zeroes out MDA’s directed energy programs entirely. Despite explicit congressional legislation and appropriations directing that MDA should develop the sensor payload for a space-based missile tracking layer, the budget once again attempts to move its development from MDA to SDA. Given the newness of SDA and its uncertain future, the relocation of the sensor payload from a missile defense-centric organization to one with a much broader mandate could jeopardize the underlying mission. Should the proposed 2021 budget shifts go unchanged, they would accelerate a trend whereby MDA is doing less advanced technology and more procurement. Such a shift would have long- term, adverse consequences for the larger missile defense enterprise. Another feature of the budget is the maturing of the services’ own air and missile defense programs, as Army and Navy investments shift from research and development to procurement and fielding.

These and other changes represent an inflection point for the missile defense enterprise, one characterized by as much uncertainty about policy, posture, programs, and institutions as any time in the last decade.4

Missile Defense and Defeat

The 2021 budget submission includes $20.3 billion allocated to what it calls “missile defense and defeat” activities. This number contains traditional missile defense programs funded in MDA and the military services but also programs usually associated with strategic missile warning and certain programs to counter missile threats prior to launch, including hypersonic strike and cyberattack (Figure 2). This number at first appears to be a significant boost to the $13.6 billion (then-year dollars) requested in 2020 for DOD-wide missile defense and defeat, but this is rather because the reporting methodology has changed. Using this new accounting, the 2021 request actually represents a 5.6 percent decline relative to the $21.5 billion (then-year dollars) appropriated in 2020.5

Figure 2: Missile Defense and Defeat in the 2021 Request

The Missile Defense Agency

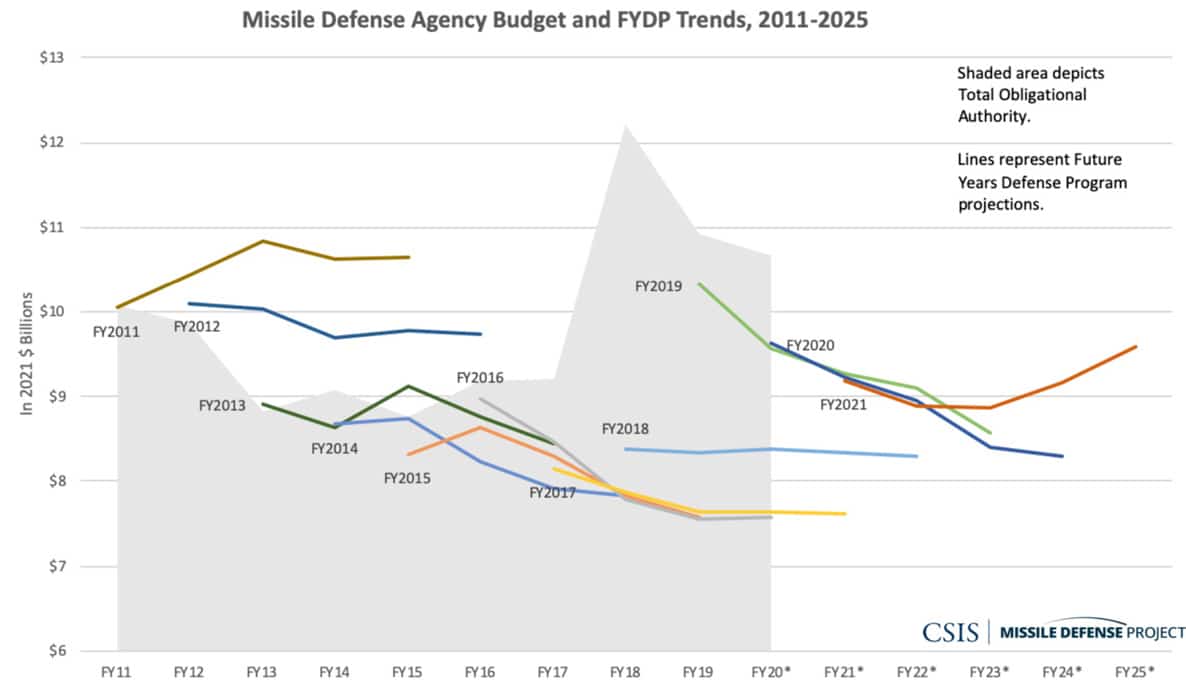

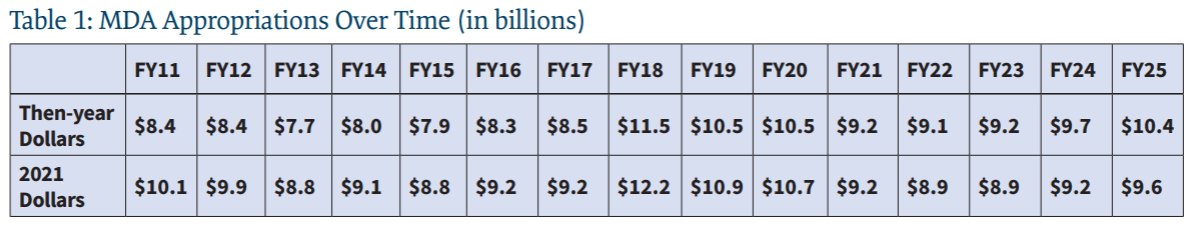

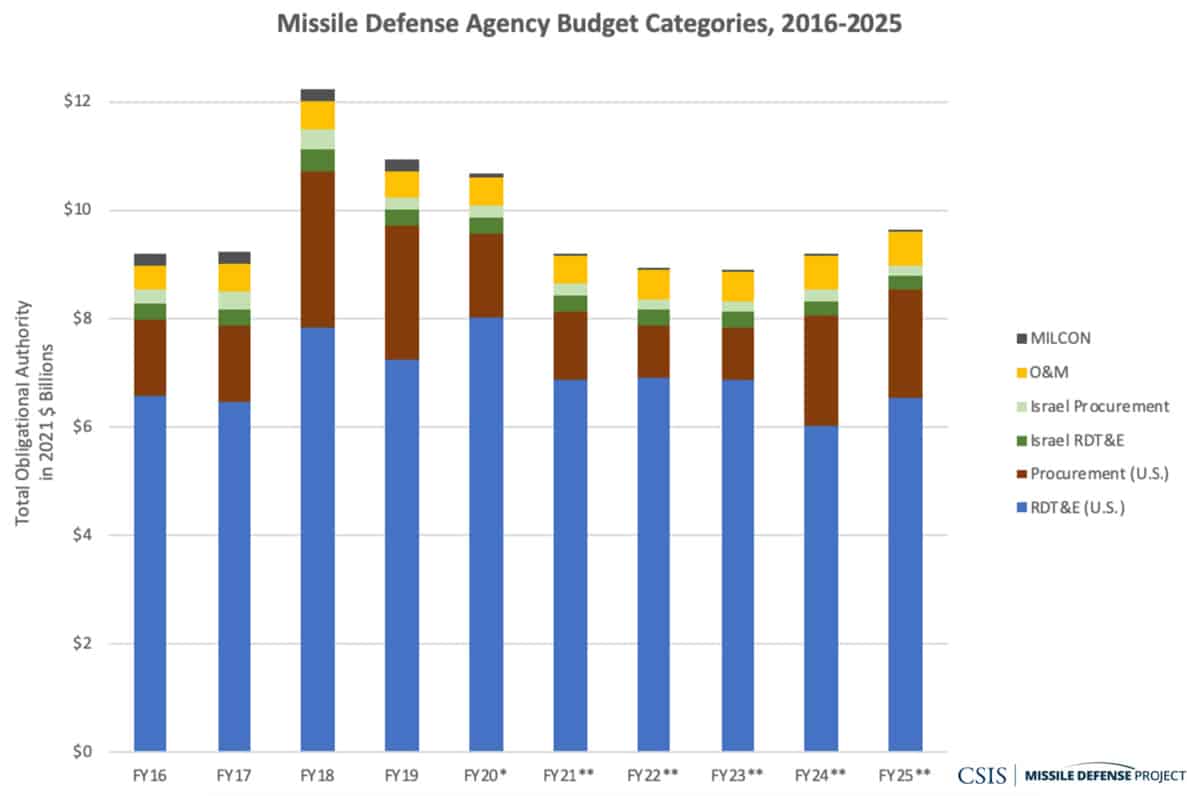

The most significant part of the missile defense enterprise remains the Missile Defense Agency. MDA’s top line submission for 2021 is $9.2 billion, a 14 percent reduction from the $10.7 billion appropriated in 2020 but very close to the projection for 2021 in last year’s budget (Figure 3). While the Future Years Defense Program (FYDP) projection for MDA declines for two years, it rises again to $9.2 billion in 2024 and $9.6 billion in 2025 (Table 1).

Figure 3: MDA Budget and FYDP Trends, 2011-2025

MDA’s FYDP also reflects an emerging emphasis on procurement. As NGI development surges, MDA projects overall procurement spending to initially fall from $1.5 billion in 2021 to around $1.2 billion in 2022 and 2023. In 2024 and 2025, MDA procurement rebounds to about $2.2 billion each year, a 49 percent increase compared to 2021 levels that drives out-year top line growth (Figure 4). Procurement of existing systems are MDA’s top three 2021 unfunded priorities: more SM-3 IIA missiles, an eighth THAAD battery, and THAAD vehicles.6 Projected procurement for the SM-3 IIA is the principal driver of MDA’s top line growth in 2024 and 2025. Following increases in RDT&E funding over the last few years, MDA research and development is projected to decline in real terms over most of the FYDP. This trend mirrors the broader Pentagon, which projects a 13 percent decline in RDT&E funding across the FYDP.

Figure 4: MDA Budget Categories, 2016-2025

The Homeland Shuffle

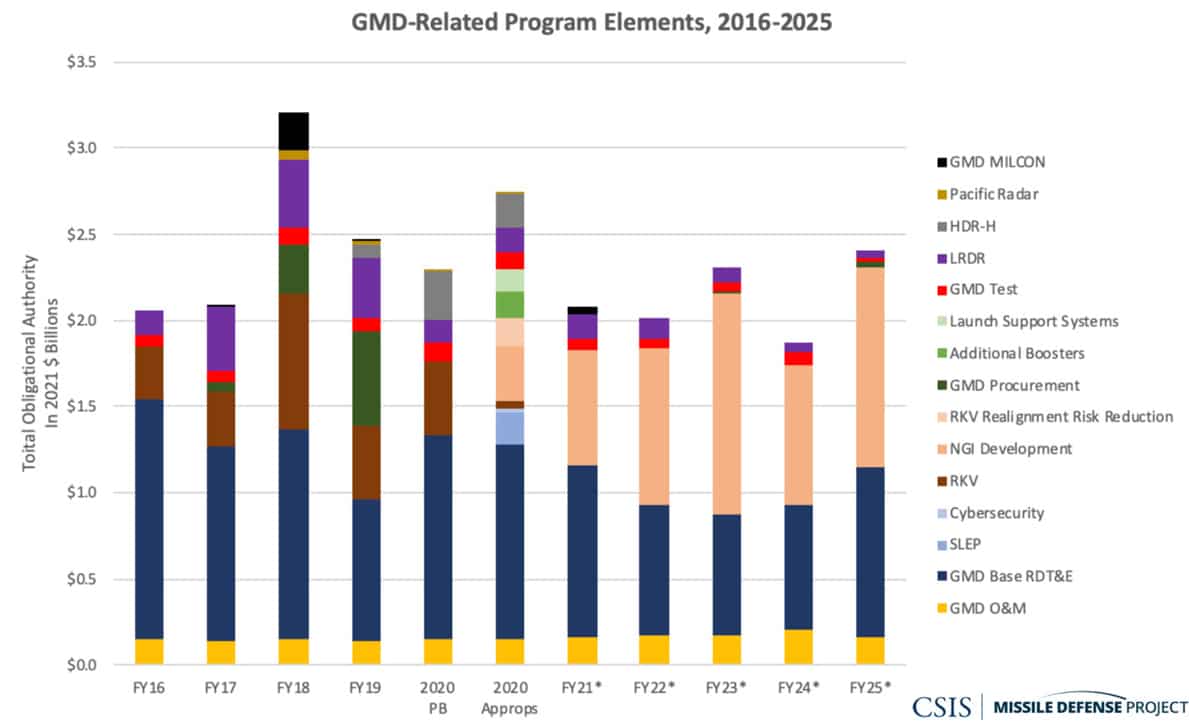

MDA’s biggest programmatic movements relate to the proposed reshuffling of homeland ballistic missile defense programs, with RKV development and Ground Based Interceptor (GBI) procurement redirected to NGI (Figure 5). The 2021 budget also cancels the two homeland defense radars intended for Hawaii and elsewhere in the Pacific.

Figure 5: GMD-Related Program Elements, 2020-2025

Initial research and development for NGI represents the largest muscle movement in the 2021 budget submission, which devotes $4.8 billion to the effort over five years. Procuring and fielding 20 interceptors over the next five years could require at least as much funding. After several draft NGI Request for Proposal (RFP) documents were circulated to industry, a final or near-final RFP is expected soon. Undersecretary Griffin also seems intent on restructuring the contract basis for the entire GMD program when it expires in 2023.7 One Request for Information (RFI) was released in mid-2019 to collect ideas for such restructuring, and another RFI could be released soon.

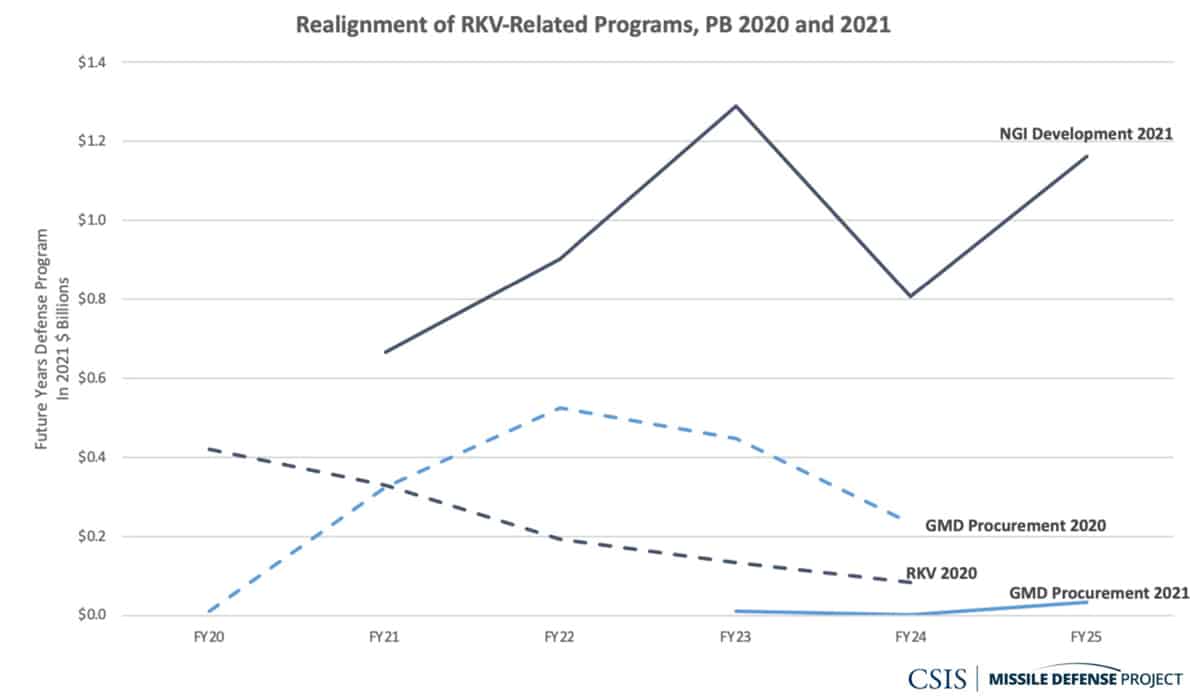

Over the next five years, NGI is projected to consume about 14 percent of MDA’s RDT&E account. The planned transition of RKV from development to procurement is also gone. Whereas the 2020 budget had previously proposed to spend $1.5 billion between 2020 and 2024 to procure 20 additional GBIs, GMD procurement is now essentially nonexistent within the FYDP, except for $45 million in the out years (Figure 6).

Figure 6: Realignment of RKV-related Programs, President’s Budget Requests for 2020 and 2021

The decision to cancel RKV also effectively terminated plans to deploy 20 additional GBIs at Fort Greely, one of the Trump administration’s few new concrete programs.8 MDA will nevertheless complete the construction of 20 additional silos in Missile Field 4, which creates flexibility for ground system operations and sustainment and supports the subsequent fielding of 20 NGIs.9

The cost, timeline, and manner of rollout for NGI sparked backlash and doubts about its sustainability. A Joint Requirements Oversight Council (JROC) meeting on February 11 reportedly declined to validate the requirements for NGI, demonstrating concern about the plan’s ability to deliver at the speed of relevance.10 Similar bipartisan congressional concern was expressed during the 2020 appropriations process, which ended with about $450 million for near-term GBI improvements and life extensions to today’s kill vehicles.11 The path forward for both NGI and interim solutions remains unclear. Modified requirements that open up the possibility of earlier fielding were then reportedly approved at a March 10 JROC meeting.12 If NGI delivery is successfully pulled to the left, GMD procurement could begin as soon as FY 2026. MDA’s ambition is to deliver the first NGI rounds in the 2027-2028 timeframe, but this will be a challenge.

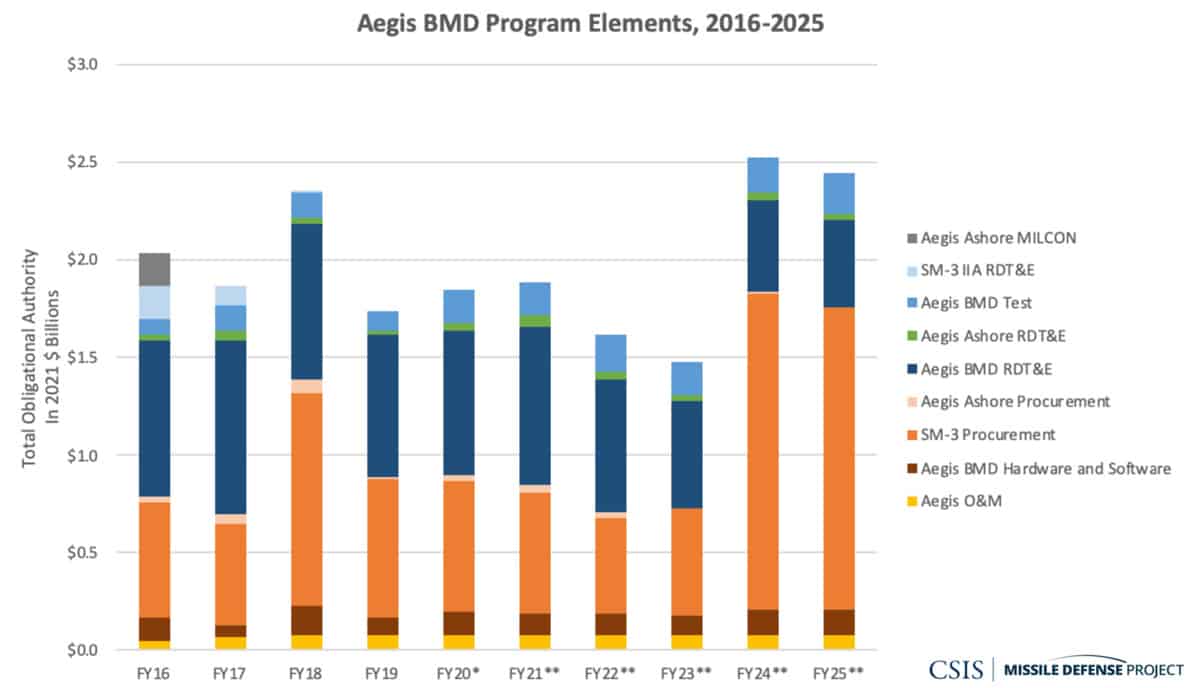

Aegis and THAAD

To hedge against NGI’s long timeline, the 2021 budget proposes to evolve regional missile defense interceptors to support homeland defense. Work will begin on adapting two regional missile defense systems, the SM-3 IIA and THAAD, as a layered underlay to defend the homeland until NGI is ready for fielding. As previously directed by Congress, MDA will test an SM-3 IIA against an ICBM-class target later this spring. MDA’s budget submission includes a combination of SM-3 IIA and THAAD interceptors as a homeland defense underlay (Figure 7). Decisions about such a deployment, however, may not be made for several years. The sizable out-year procurement of IIA missiles does not just reflect the potential for a homeland underlay, however, but also their intended deployment aboard Aegis destroyers and at two European Aegis Ashore sites.

MDA’s 2021 budget submission includes $39.2 million to assess upgrades to the Aegis Combat System (ACS) for homeland defense.13 Should an Aegis-based underlay proceed, it could be configured around ships deployed off the coast or through a modified Aegis Ashore site. Plans to use additional Aegis BMD ships for homeland missile defense missions could create tension with the Navy, which already has voiced concerns about the strain ballistic missile defense operations create on the fleet.14 Building an Aegis Ashore site in the United States has the advantage of multi-mission air and missile defense capability but could force other tradeoffs. Defense officials have also noted that Aegis Ashore is under consideration for Guam, where one THAAD battery is currently deployed.15

Figure 7: Aegis BMD Program Components, 2016-2025

MDA also proposed $139 million for a new development program to modify the THAAD system for homeland defense missions. These improvements to THAAD could include past concepts for an extended range interceptor, but MDA Director Vice Admiral Jon Hill has stated that MDA would also evaluate other options, such as improved seeker or divert enhancements.16 Hill emphasized the advantages of endo-atmospheric intercept in stripping out certain countermeasures, pointing to the benefits of layering THAAD and SM-3 together.

Figure 8: THAAD Program Elements, 2016-2025

Another major development this year is the indefinite deferral of funding for the pair of Homeland Defense Radars, for Hawaii and elsewhere in the Pacific. Objections from local constituencies had already delayed the Hawaii radar intended for Oahu and prompted consideration of its relocation to Kauai.17 The delays on the two radars reintroduce doubt about the midcourse tracking gap for the Pacific. Although funds for the Hawaii radar were reportedly redirected toward other sensors to support layered homeland defense, the cost savings from the Pacific radar seem to have been redirected to “other DOD priorities” outside the missile defense portfolio.18 Near-term solutions to the midcourse gap include extending the operational deployment of the Sea-based X-Band Radar. Nevertheless, some additional sensor is likely also needed for the defense of Hawaii, which could mean the return of a THAAD battery or the operational activation of the Pacific Missile Range Facility as a form of Aegis Ashore with either its SPY-1 or a TPY-2 radar. Another option could be to adjust ship rotations to defend the island using Aegis ships. MDA plans to field its Long Range Discrimination Radar (LRDR) in 2020, with full operations starting in 2022, which will improve overall coverage but not close the gap for the defense of Hawaii.19 A secretary of defense-directed study of the overall sensor architecture for INDOPACOM should analyze these, as well as space-based alternatives.

Whither Space Sensors?

The 2021 budget renews broader institutional questions about the development of advanced technology for missile defense. These are felt most sharply with the space sensor layer. The 2020 budget attempted to move the sensor development from MDA to SDA, but Congress pushed back, insisting in the 2020 National Defense Authorization Act (NDAA) that MDA be given the lead to develop the Hypersonic and Ballistic Tracking Space Sensor (HBTSS). Despite the fact that HBTSS had received negligible funding in the Trump administration’s 2020 budget proposal, Congress in the 2020 appropriations bill funded HBTSS to $108 million, the full amount identified in MDA’s unfunded requirement.20

Despite this clear statutory direction, MDA receives no HBTSS funding in the 2021 budget. Instead, Under Secretary Griffin chose to move the sensor development to SDA. An initial hearing for the House Armed Services Committee’ subcommittee on Strategic Forces indicates bipartisan concern about the move. “The space sensor layer is underfunded and, despite congressional direction, was given to the nascent Space Development Agency,” said subcommittee chairman Jim Cooper (D-TN) in his opening statement. “I like Dr. Griffin, but he should have come back to us and talked to us before he made that decision,” said Mike Rogers (R-AL).21

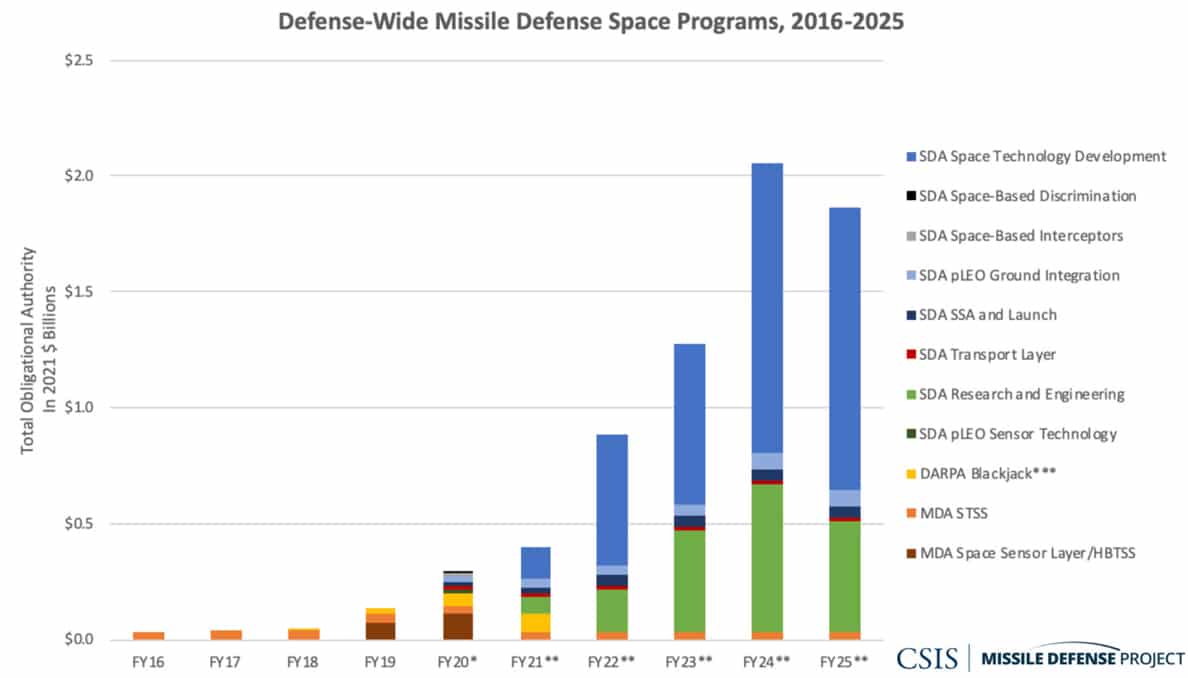

While the SDA’s budget justification documents lack details on HBTSS, the broader lines for Research and Engineering and Space Technology Development program elements suggest the program could have a healthy funding profile (Figure 9). Besides broader questions about the future of SDA as an institution, however, it is unclear that SDA plans to move out on hypersonic and ballistic missile tracking at the speed of relevance. According to the Department of Defense 2021 Budget Overview, SDA plans to invest $99.6 million in a space-based missile tracking, about 10 percent less than that appropriated in 2020. A demonstration of some kind is not planned until 2023.22 Vice Admiral Hill testified that MDA would work closely with SDA on HBTSS and that the funds would be provided to MDA for execution.23

Figure 9: Defense-Wide Missile Defense Space Programs, 2016-2025

While the overall SDA funding profile might seem encouraging, there are reasons to doubt the wisdom of tasking SDA with the sensor development. Established in March 2019, SDA remains in its infancy as an acquisition and development organization. A further source of uncertainty is SDA’s planned transfer to the Space Force in 2022, which could affect its ability to acquire capabilities as quickly as it would in a Defense-Wide organization.24 Even today, SDA relies on Middle Tier Acquisition (MTA) authority for most of its rapid acquisition, a mechanism that recent policy guidance may slow.25 MDA has demonstrated the ability to use its more flexible acquisition authorities to develop, deploy, and operate satellites, including the Space Tracking and Surveillance System (STSS) demonstrators and commercially hosted Space-based Kill Assessment (SKA) payload.

Another concerning trend in space-based sensors is the potential for the program to lose its multi-mission requirements. Both SDA and the nascent Space Force have a broad mandate and will not have the missile defense-centric focus of MDA. Doubts that transferring HBTSS could dilute its broader missile defense mandate seem to be reflected in the DOD Budget Overview, which refers to SDA efforts to “develop and demonstrate a hypersonic tracking layer.”26 Taking the “B” out of HBTSS and downgrading the space sensor layer would be penny wise, pound foolish. It could ultimately necessitate further time and investment in a second space- or ground-based sensor architecture for ballistic threats.

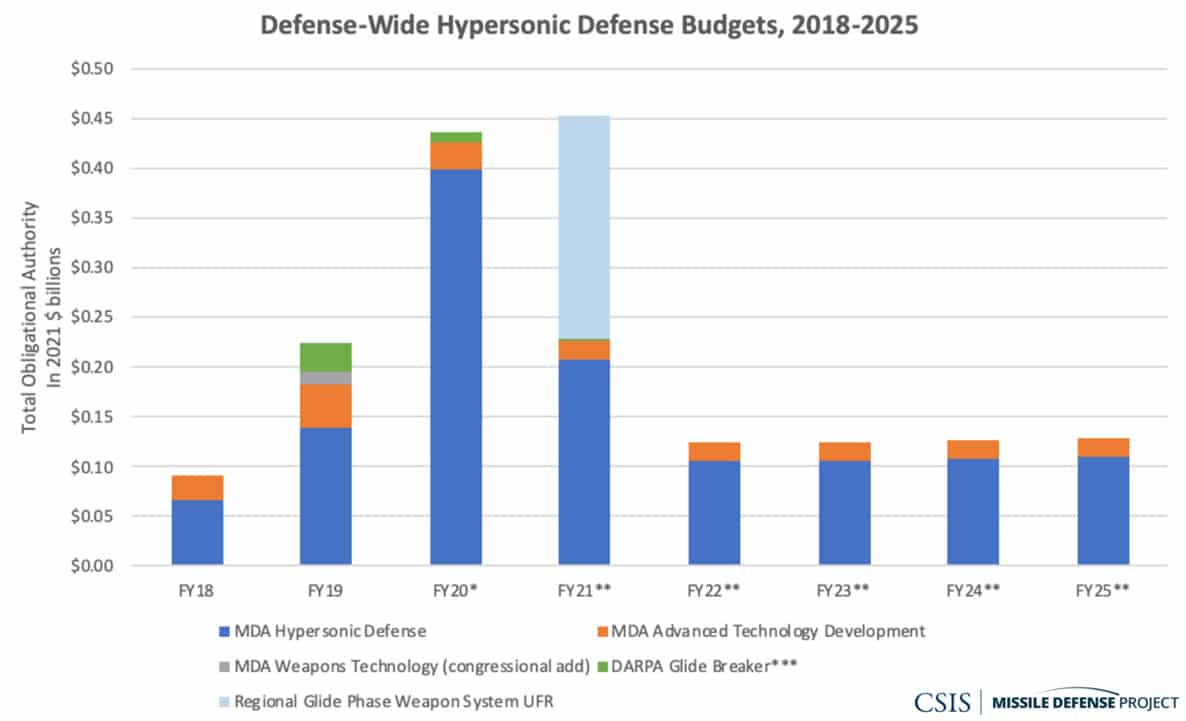

Hypersonic Defense and Advanced Technology

The ability to track hypersonic missiles would be useful even for strategic warning, but intercepting them also requires interceptors and a command and control backbone. The 2020 MDA unfunded requirements list had included around $720 million for hypersonic defense, signaling that while the program has significant demand for funding, the dollars have so far not followed. In its 2020 appropriations, Congress added a portion of that amount, bringing MDA’s total hypersonic defense appropriation up near $400 million, with an additional $40 million for advanced technology development. MDA’s 2021 unfunded requirements (UFR) list includes $224 million for hypersonic defense, principally for the Regional Glide Phase Weapon System (Figure 10).27 Should that unfunded priority be appropriated in 2021, the funding profile would be comparable to that of 2020.

Figure 10: Defense-Wide Hypersonic Defense Budgets, 2018-2025

Hypersonic defense is not the only advanced technology program with a disappointing outlook. The 2021 budget also cancelled MDA’s Directed Energy Demonstrator program, effectively ending its investment in boost-phase missile defense.28 Should research on directed energy research elsewhere in the Department yield promising applications, work could resume at MDA to develop mission-specific capabilities. Another program potentially crowded out of the budget and into the list of unfunded priorities is indications and warning for homeland cruise missile defense.29 To support this mission, the list of unfunded requirements identifies $39.2 million to integrate existing sensors into the Command and Control, Battle Management, and Communications (C2BMC) system.

Growing Service AMD Efforts

The past few years have seen a renewed attention to air and missile defense within the several military services, especially for lower-tier aerial threats that fall below MDA’s traditional focus. The treatment here of service programs focuses on modernization, defined as procurement and RDT&E. Combined service spending in these areas grows to $9.3 billion, up 20 percent from the $7.7 billion appropriated in 2020. The Army and the Navy budgets, in particular, reflect a shift from recent RDT&E investments to increased procurement over the FYDP.

Army Programs

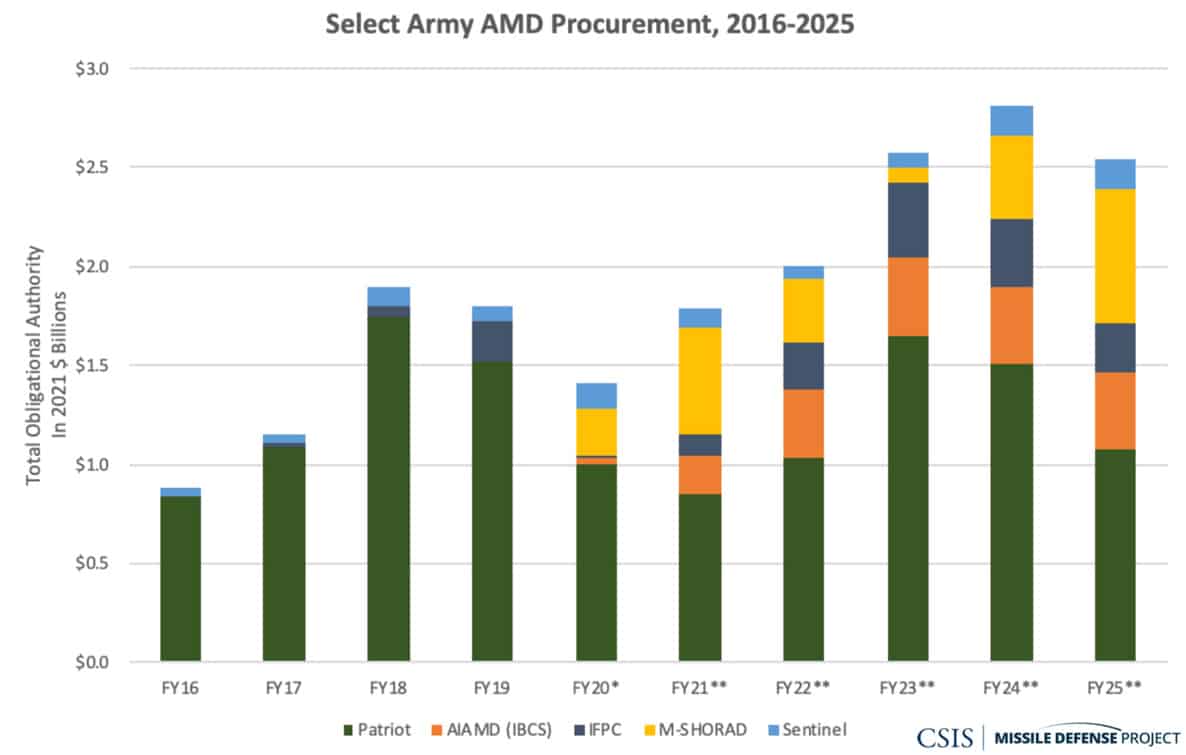

Since the Army announced air and missile defense as one of its six modernization priorities, its budgets have steadily grown. In 2021, the Army devotes $3.3 billion to air and missile defense modernization, a 16 percent increase from the $2.9 billion enacted in 2020. Although the FYDP projects these investments will flatten, air and missile defense spending never drops below $3 billion.

For years, Patriot has been the principle driver of the Army air and missile defense procurement. The Army plans to spend $847 million on new purchases of Missile Segment Enhancement (MSE) interceptor and other element upgrades in 2021, a number slated to grow to $1.6 billion in 2023 (Figure 11). Throughout the next FYDP, however, Army procurement begins to diversify. Recent research and development investments seem to be paying off, as the RDT&E programs decline and procurement grows for programs such as Maneuver-Short-Range Air Defense (M-SHORAD) and the Integrated Air and Missile Defense Battle Command System (IBCS). These more diverse and layered air defense capabilities take on new importance both for complex and integrated attack from major powers but also for the kind of attacks conducted recently in Iraq and Saudi Arabia. Notably, $177 million of the Army’s 2021 Patriot request falls in the Overseas Contingency Operations (OCO) account, as does $158 million for M-SHORAD.

Figure 11: Select Army AMD Procurement, 2016-2025

The Army continues its planned purchase of two Iron Dome batteries as an interim solution given delays in its Indirect Fire Protection Capability (IFPC) program. IFPC is meant to defend fixed and semi-fixed targets against more stressing cruise missile and other aerial attacks. Budget projections reflect the current uncertainty for IFPC. After spending about $200 million in 2019 to support an initial capability, IFPC procurement declined to about $9 million in 2021, reflecting a reevaluation and redirection of that program. The 2021 IFPC request rebounds to $106 million, but that figure is about half of what the 2020 budget projected for this year, with larger investments pushed further into the future.

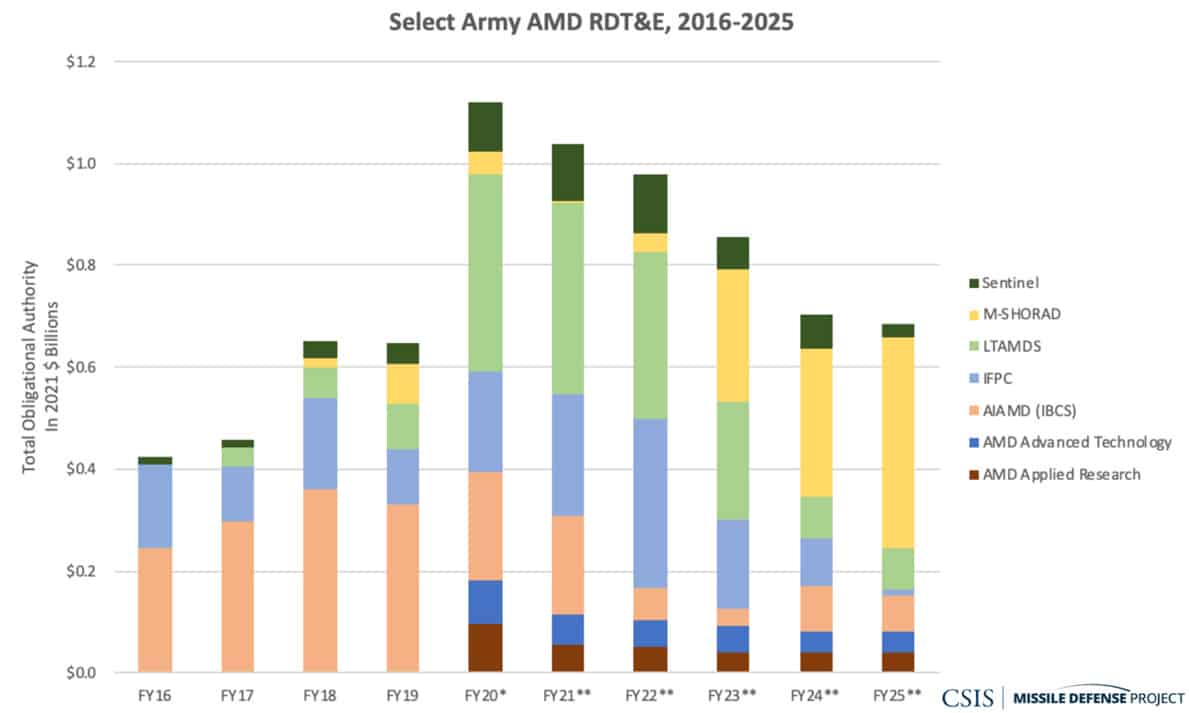

The Army’s stated top priority in air and missile defense remains IBCS, a system designed to tie together disparate sensors and interceptors into a single fire control network. The Army’s $202 million 2021 request would go toward converting two Patriot battalions to the IBCS network as part of low-rate initial production.30 Begun in 2020, IBCS procurement is expected to increase in the coming years, with initial operational capability planned for 2022. Transitioning IBCS to initial production drives the overall RDT&E decline for Army air and missile defense, going from a high of $1.4 billion in 2020 down to $846 million in 2025 (Figure 12). The recently awarded Low Tier Air and Missile Defense Sensor (LTAMDS) radar will be the largest RDT&E element for the next few years. With a planned initial operating capability in 2022, part of its funding could also soon transfer to the procurement account.

Figure 12: Select Army AMD RDT&E, 2016-2025

Estimates for IFPC show a similar approach: a short-term spike in RDT&E funding between 2020 and 2022, followed by a sharp decline between 2023 and 2025. The Army continues its assessment of whether that RDT&E effort will pursue a U.S. industry launcher and interceptor for cruise missile defense or whether it will use the Iron Dome launcher and interceptor. The Army plans to achieve a limited operational capability for IFPC in 2023, transitioning to procurement of its new system in 2025.31 Toward the end of the FYDP, M-SHORAD RDT&E expands significantly, supporting Army plans to field a follow-on version of the system to replace its current interim solution. According to the Army justification documents, this funding will develop a suite of options for short-range air defense, including a directed energy system, a new kinetic interceptor, and a dismounted capability to make it more expeditionary.32

Navy Programs

The Navy continues its healthy air and missile defense investment in the 2021 budget submission. Because its procurement of shipboard systems is coupled tightly to its shipbuilding budget overall, tracking overall Navy procurement of air and missile defense-specific assets is difficult. Procurement of components like the Aegis Weapons System (AWS) and Cooperative Engagement Capability (CEC) is tied to planned shipbuilding budgets, for instance, and do not report FYDP data independently. With regards to Arleigh Burke destroyers, the primary Navy air and missile defense platform, the 2021 FYDP projects cuts to shipbuilding. Those plans will likely change in response to the Naval Force Structure Assessment expected in early 2020.33

Navy interceptor procurement sees significant growth in the 2021 budget request. The Navy estimates increased funding for a variety of interceptors, including Standard Missile-6 (SM-6), modifications to older Standard Missile-2 (SM-2) missiles, the Evolved Sea Sparrow Missile (ESSM), and interceptors for the Marine Corps’ Ground-Based Air Defense (GBAD) program (Figure 13). Between 2021 and 2025, Navy and Marine Corps procurement of these four interceptors is due to grow from $841 million to $1.9 billion, a 123 percent increase. This trend mirrors a rise in Navy procurement of antiship missiles, demonstrating a commitment to offsetting Chinese maritime force projection.34

Figure 13: Selected Navy and Marine Corps Interceptor Procurement, 2016-2025

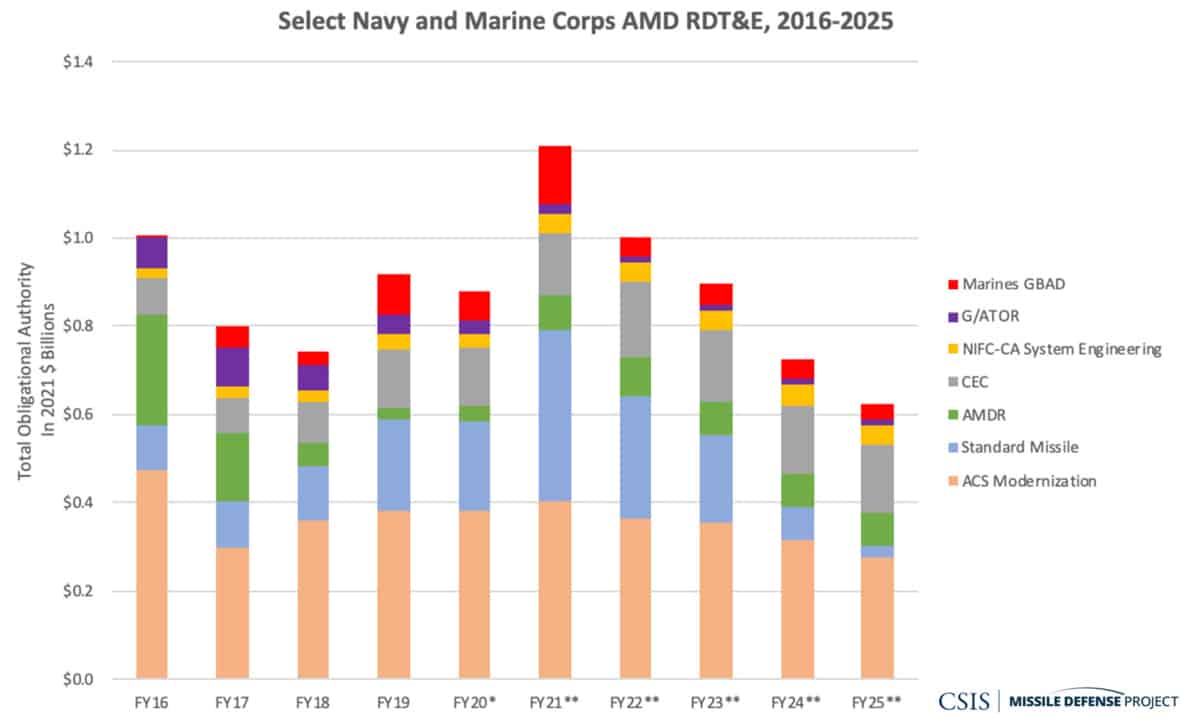

The Navy also estimates that its RDT&E for air and missile defense will fall over the FYDP. Much of this decline is due to lower RDT&E and more procurement for the SM-6 (Figure 14). In 2023, the Navy plans to test its first SM-6 Block IB, a new fully 21-inch version for extended range.35

Figure 14: Select Navy and Marine Corps AMD RDT&E, 2016-2025

Air Force and Space Force

In the Pentagon’s broader accounting for missile defense and defeat, the Air Force and Space Force are said to contribute to missile defense primarily through programs related to missile launch detection and strategic warning, which has historically been differentiated from the missile defense-specific missions that require tracking and discrimination. Many of the programs counted here have transferred over to the newly established Space Force, including the Next Generation Overhead Persistent Infrared (OPIR) system and legacy Early Warning Radars (EWRs). Indeed, over 80 percent of the Space Force projected investment in missile defense relates to its Next Generation OPIR tracking system. The Air Force plans to invest $2.3 billion in the Next Generation OPIR program in 2021 to accelerate deployment of the new satellites slated to replace the Space Based Infrared Satellite-High (SBIRS-High) constellation. The Space Force also assumes responsibility for maintaining the EWRs and the COBRA DANE radar in Alaska, as these radars also contribute to space situational awareness. As newer OPIR and other satellites come online, it is possible that the Space Force could fuse and integrate their information to operationally support missile defense fire control. Another change, however, comes in the area of boost phase missile defense, which Air Force budget documents no longer reference, as they had in 2020.

Hypersonic Strike

The final category of missile defense and defeat funding is the defeat side, which principally includes programs for prompt strike operations that might be integrated into an overall posture to counter missiles both before and after launch. As reported, missile defeat activities are said to comprise $3.2 billion in the 2021 request. Nevertheless, certain elements of this request are challenging to itemize because they include cyberattack or other capabilities that are difficult to isolate within broader line items. The analysis herein focuses on hypersonic strike elements related to missile defeat.

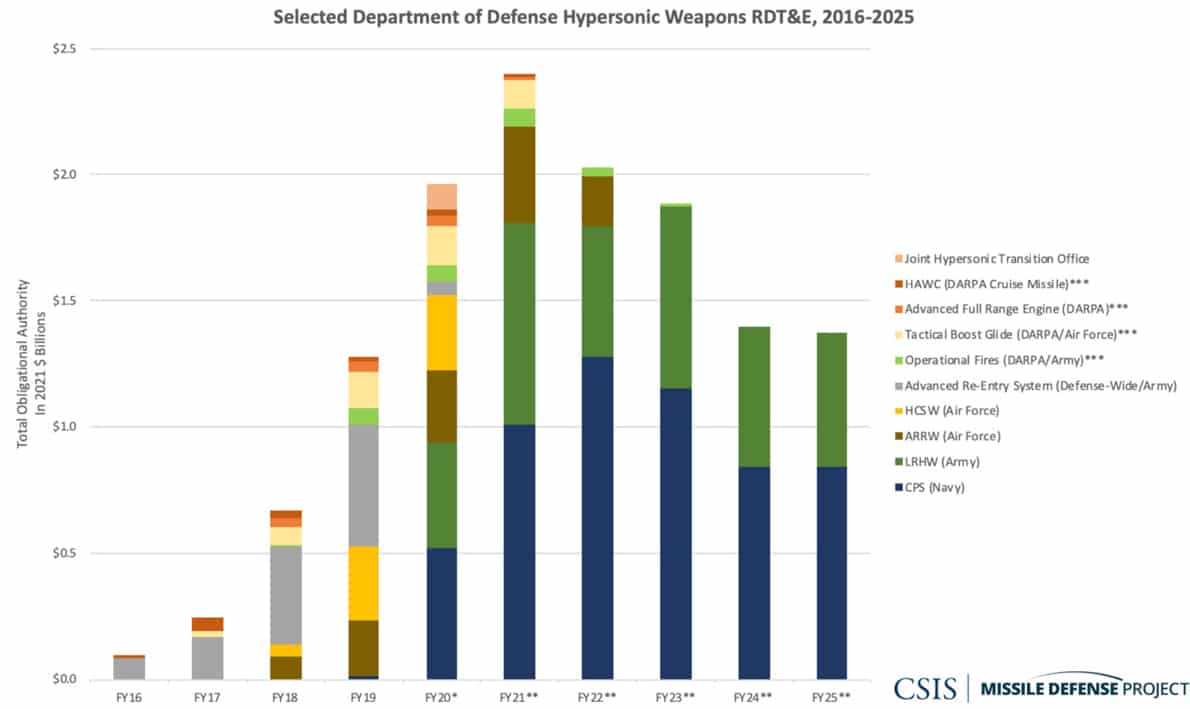

As tabulated here, the 2021 budget continues the significant growth in hypersonic weapon budgets to nearly $2.5 billion (Figure 15). The 2021 request also continues the trend of transferring hypersonic weapons investment from Defense-Wide accounts to the military services as the technologies mature. In 2020, Congress appropriated $100 million to facilitate this process by setting up a Joint Hypersonic Transition Office, although the 2021 submission does not continue funding the effort.

Figure 15: DOD Hypersonic Weapons RDT&E, 2016-2025

One notable decision in this portfolio was the Air Force’s decision to cancel the scramjet-powered Hypersonic Conventional Strike Weapon (HCSW) but to continue work on the Air-launched Rapid Response Weapon (ARRW) hypersonic missile, which it first tested in June 2019 and has a target deployment date of 2022. Despite significant technical progress and an earlier fielding date for HCSW, the Air Force’s down select to ARRW had to do with the size of the airframe and therefore capacity, with perhaps twice as many ARRWs being possible to load onto a given platform.36

Into the FYDP, the largest funding profiles belong to the Army’s Long-range Hypersonic Weapon (LRHW) and the Navy’s Conventional Prompt Strike (CPS), which share a common glide body. The Army plans to field its first experimental batteries of LRHW in 2023, with the Navy following with a 2028 target for an initial operating capability for its CPS missiles on Virginia-class attack submarines.37

In addition to hypersonic strike, the Army and Navy continue to pursue shorter-range strike missiles that could have missile defeat applications. The Army canceled its Mobile Medium-range Missile in the 2021 budget submission after its budget was cut during the appropriations process, leaving the LRHW as its main long-range strike platform, besides the Strategic Cannon effort and the shorter-range Precision Strike Missile (PrSM). The Marine Corps for the first time includes the procurement of 48 Tomahawk missiles, presumably for land-basing.38

Period of Transition

When rolling out the 2021 budget, numerous Pentagon statements emphasized that the Department intends to create an “irreversible implementation of the National Defense Strategy.”39 In the service’s air and missile defense efforts and in the demand signal for hypersonic strike, this characterization may be accurate. But broader questions raised by some of its signature investments, most notably for homeland missile defense, suggest that the 2021 budget request reflects a moment characterized more by uncertainty than irreversibility. This uncertainty is especially pronounced in areas of advanced technology, much of which has been moved out of MDA. Although NGI receives considerable funding, considerable doubt now surrounds the future of hypersonic defense, homeland cruise missile defense, directed energy, the space sensor layer, and the shape of the larger missile defense enterprise.

Footnotes

- The $4.7 billion in Missile Defense and Defeat Enhancements added to the 2018 budget principally represented increases in capacity rather than capability. See Tom Karako and Wes Rumbaugh, “Dissecting the Big Missile Defense Plus-up,” CSIS, CSIS Commentary, December 5, 2017, https://www.csis.org/analysis/dissecting-big-missile-defense-plus.

- Tom Karako and Wes Rumbaugh, “Masterpiece Theater: Missed Opportunities for Missile Defense in the 2020 Budget,” CSIS, CSIS Briefs, March 29, 2019, https://www.csis.org/analysis/masterpiece-theater-missed-opportunities-missile-defense-2020-budget.

- U.S. Joint Chiefs of Staff, Joint Publication 3-01, Countering Air and Missile Threats (Washington, DC: Department of Defense, May 2018), https://www.hsdl.org/?abstract&did=706098.

- Tom Karako, “Inflection Point: Thoughts on the Next Generation Interceptor” (remarks, Royal United Services Institute, London, UK, February 26, 2020).

- The budget’s reporting method for missile defense and defeat is somewhat opaque, given that DOD’s list of figures is not easily reproduced for direct comparison. In terms of methodology, the analysis herein covers all MDA programs, a modified list of service and other Defense-Wide air and missile defense programs, and a selection of missile defeat activities such as hypersonic strike. MDA’s budget is relatively self-contained, so their operations and maintenance (O&M) and military construction (MILCON) accounts are included here. Service O&M and MIILCON accounts tend to be more difficult to parcel out to individual systems or missions, so the analysis of service programs is limited to procurement and RDT&E. Unless otherwise noted, all figures are here are inflation adjusted to 2021 dollars. For a more complete account of programs included here, see our online tracker at https://missilethreat.csis.org/fy-2021-missile-defense-and-defeat-budget-trackers/.

- Missile Defense Agency, Report on Unfunded Priorities for the Missile Defense Agency (Fort Belvoir: MDA, February 2020), 5.

- Wes Rumbaugh, “A New Generation of Homeland Missile Defense Interceptors,” CSIS, CSIS Critical Questions, November 12, 2019, https://www.csis.org/analysis/new-generation-homeland-missile-defense-interceptors.

- Department of Defense, Missile Defense Review Report (Washington, DC: Department of Defense, 2019), XIII, https://www.defense.gov/Portals/1/Interactive/2018/11-2019-Missile-Defense-Review/The%202019%20MDR_Executive%20Summary.pdf.

- Jon Hill and Michelle Atkinson, “Department of Defense Press Briefing on the President’s Fiscal Year 2021 Defense Budget for the Missile Defense Agency,” (press briefing, Pentagon, February 10, 2020), https://www.defense.gov/Newsroom/Transcripts/Transcript/Article/2080378/department-of-defense-press-briefing-on-the-presidents-fiscal-year-2021-defense/.

- Jason Sherman, “NORTHCOM Chief Renounces 10-year NGI Plan, Reveals New Effort to Scale Back Requirements,” Inside Defense, February 13, 2020, https://insidedefense.com/daily-news/northcom-chief-renounces-10-year-ngi-plan-reveals-new-effort-scale-back-requirements.

- Courtney Albon and Jason Sherman, “House Investigating RKV Termination, Challenging Griffin’s ‘Convenience’ Call,” Inside Defense,November 1, 2019, https://insidedefense.com/daily-news/house-investigating-rkv-termination-challenging-griffins-convenience-call.

- Jason Sherman, “NGI passes muster with JROC, RFP ‘about to be released’,” Inside Defense, March 11, 2020, https://insidedefense.com/daily-news/ngi-passes-muster-jroc-rfp-about-be-released.

- Missile Defense Agency, Budget Estimates Overview: Fiscal Year (FY) 2021 (Fort Belvoir, VA: MDA, February 2020), 9.

- David B. Larter, “The US Navy is Fed Up With Ballistic Missile Defense Patrols,” Defense News, June 16, 2018, https://www.defensenews.com/naval/2018/06/16/the-us-navy-is-fed-up-with-ballistic-missile-defense-patrols/.

- John Rood, “Security Update on the Korean Peninsula,” testimony before the House Armed Services Committee,116th Cong., January 28, 2020, https://armedservices.house.gov/2020/1/full-committee-hearing-security-update-on-the-korean-peninsula.

- Hill and Atkinson, “Department of Defense Press.”

- Mahealani Richardson, “Kauai military site named as possible site for $1.9B ballistic missile radar,” Hawaii News Now,January 22, 2020, https://www.hawaiinewsnow.com/2020/01/22/kauai-military-site-named-fourth-possible-site-b-ballistic-missile-radar/.

- Hill and Atkinson, “Department of Defense Press Briefing.”

- Missile Defense Agency, Budget Estimates Overview, 4.

- National Defense Authorization Act for Fiscal Year 2020, Pub. L. 116-92, Sec. 1683, 116th Congress, (December 17, 2019).

- “FY21 Priorities for Missile Defense and Missile Defeat Programs,” hearing before the House Armed Services Strategic Forces Subcommittee,116th Cong., March 12, 2020, https://armedservices.house.gov/2020/3/subcommittee-on-strategic-forces-hearing-fy21-priorities-for-missile-defense-and-missile-defeat-programs.

- Office of the Secretary of Defense (Comptroller)/Chief Financial Officer, Defense Budget Overview: Irreversible Implementation of the National Defense Strategy (Arlington, VA: OSD, February 2020), 4-11, https://comptroller.defense.gov/Portals/45/Documents/defbudget/fy2021/fy2021_Budget_Request_Overview_Book.pdf.

- Jon Hill, “FY21 Priorities for Missile Defense and Missile Defeat Programs,” hearing before the House Armed Services Strategic Forces Subcommittee, 116th Cong., March 12, 2020, https://armedservices.house.gov/2020/3/subcommittee-on-strategic-forces-hearing-fy21-priorities-for-missile-defense-and-missile-defeat-programs.

- Debra Werner, “Will Space Force Oversight Constrain SDA? Current and Former Bosses Offer Contrasting Views,” Space News,February 7, 2020, https://spacenews.com/kennedy-tournear-space-force/.

- Patrick M. Shanahan, “Establishment of the Space Development Agency,” (memo, Department of Defense, March 12, 2019), https://aerospace.csis.org/wp-content/uploads/2019/04/Establishing_SDA_DoD_Memorandum.pdf; and Eric Lofgren, “Too Many Cooks in the DOD: New Policy May Suppress Rapid Acquisition,” Defense News,January 2, 2020, https://www.defensenews.com/opinion/commentary/2020/01/02/too-many-cooks-in-the-dod-new-policy-may-suppress-rapid-acquisition/.

- Office of the Secretary of Defense, Defense Budget Overview, 4-11.

- Missile Defense Agency, Report on Unfunded Priorities for the Missile Defense Agency, 5.

- Hill and Atkinson, “Department of Defense Press Briefing.”

- Missile Defense Agency, Report on Unfunded Priorities for the Missile Defense Agency, 5.

- United States Army, Department of Defense Fiscal Year (FY) 2021 Budget Estimates: Army Other Procurement: Communications and Electronics Equipment (Washington DC: Department of the Army, 2020), 482.

- United States Army, Department of Defense Fiscal Year (FY) 2021 Budget Estimates: Research, Development, Test & Evaluation, Army RDT&E,Volume II, Budget Activity 5 (Washington DC: Department of the Army, 2020), 363.

- United States Army, Department of Defense Fiscal Year (FY) 2021 Budget Estimates: Research, Development, Test & Evaluation, Army RDT&E, Volume II, Budget Activity 4 (Washington DC: Department of the Army, 2020), 547.

- Justin Katz, “Modly Sets Jan. 15 as Deadline to Publish New Navy Force Structure Assessment,” Inside Defense, December 9, 2019, https://insidedefense.com/daily-news/modly-sets-jan-15-deadline-publish-new-navy-force-structure-assessment.

- David B. Larter, “As China Expands Navy, US Begins Stockpiling Ship-Killing Missiles,” Defense News,February 11, 2020, https://www.defensenews.com/naval/2020/02/11/as-china-continues-rapid-naval-expansion-the-us-navy-begins-stockpiling-ship-killing-missiles/.

- United States Navy, Department of Defense Fiscal Year (FY) 2021 Budget Estimates: Research, Development, Test & Evaluation, Navy RDT&E, – Volume III, Budget Activity 5 (Washington DC: Department of the Navy, 2020), 662.

- Valerie Insinna, “US Air Force Kills One of Its Hypersonic Weapons Programs,” Defense News, February 10, 2020, https://www.defensenews.com/smr/federal-budget/2020/02/10/the-air-force-just-canceled-one-of-its-hypersonic-weapons-programs/; and Garrett Reim, “Why the US Air Force Chose Hypersonic ARRW Over HCSW,” Flight Global, February, 28, 2020, https://www.flightglobal.com/fixed-wing/why-the-us-air-force-chose-hypersonic-arrw-over-hcsw/137018.article.

- Sydney J. Freedberg, Jr., “Army Wants Hypersonic Missile Unit by 2023: Lt. Gen. Thurgood,” Breaking Defense,June 4, 2019, https://breakingdefense.com/2019/06/army-wants-hypersonic-missile-unit-by-2023-lt-gen-thurgood/; and Megan Eckstein, “Navy Confirms Global Strike Hypersonic Weapon Will First Deploy on Virginia Attack Subs,” USNI News,February 18, 2020, https://news.usni.org/2020/02/18/navy-confirms-global-strike-hypersonic-weapon-will-first-deploy-on-virginia-attack-subs.

- James Clark, “Here’s Why the Marine Corps is Getting Tomahawk Cruise Missiles,” Task and Purpose,February 12, 2020, https://taskandpurpose.com/military-tech/marine-corps-tomahawk-cruise-missile.

- Elaine McCusker, Ron Boxall, and David L. Norquist, “Department of Defense Press Briefing on the President’s Fiscal Year 2021 Defense Budget” (press briefing, Pentagon, February 10, 2020), https://www.defense.gov/Newsroom/Transcripts/Transcript/Article/2080378/department-of-defense-press-briefing-on-the-presidents-fiscal-year-2021-defense/.